Profitable

Quick, user-friendly options available globally. Just one document to start

Quick, user-friendly options available globally. Just one document to start

Rely on our direct lending for security and innovation. Your data is protected, and we offer solutions when you need them

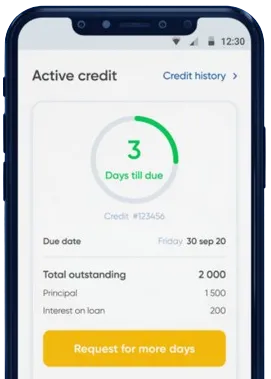

Seamless solutions in just 10 minutes from home. Instant money transfer and options to extend your loan

Use the app to send your request, simply fill in the form.

Anticipate our decision, made swiftly in 15 minutes.

Obtain your funds, usually taking only one minute to transfer.

Use the app to send your request, simply fill in the form.

Download loan app

Same day loans are a popular financial tool in South Africa, offering quick access to funds for individuals who find themselves in need of emergency cash. These types of loans have numerous benefits that make them a convenient and useful option for many South Africans.

Same day loans are known for their quick approval process, making them ideal for those who require immediate financial assistance. Most lenders in South Africa offer online applications that can be completed in minutes, with approval decisions made within hours.

For individuals facing unexpected expenses or financial emergencies, the speedy approval process of same day loans can be a lifesaver.

Unlike traditional bank loans, same day loans in South Africa typically do not require any collateral. This means that borrowers do not need to pledge their assets, such as vehicles or property, to secure the loan.

As a result, same day loans are accessible to a wider range of individuals, including those who may not have valuable assets to use as collateral.

Same day loans in South Africa offer flexibility in terms of loan amounts and repayment terms. Borrowers can typically choose the loan amount that suits their needs and select a repayment period that aligns with their financial situation.

This flexibility makes same day loans a versatile option for individuals with diverse financial needs and preferences.

One of the primary advantages of same day loans is the convenience they offer in accessing emergency funds. Whether facing a medical emergency, car repair, or unexpected bill, same day loans can provide the financial assistance needed to address urgent situations.

With the ability to apply online and receive funds quickly, same day loans are an efficient solution for individuals in need of immediate cash relief.

Same day loans in South Africa offer a range of benefits that make them a valuable financial tool for individuals in need of quick, convenient access to emergency funds. From their quick approval process to flexible loan amounts and repayment terms, same day loans provide a practical solution for managing unforeseen expenses and financial emergencies.

Same day loans are short-term loans that are designed to provide individuals with quick access to funds on the same day that they apply.

Generally, anyone who is over the age of 18, has a steady income, and a valid South African bank account can apply for a same day loan in South Africa.

In most cases, if you are approved for a same day loan, you can receive the funds in your bank account within a few hours of your application being approved.

The maximum amount you can borrow with a same day loan in South Africa varies depending on the lender, but it is typically between R500 and R20,000.

The repayment period for a same day loan is usually between 1 and 6 months, depending on the lender and the amount borrowed.

As long as you borrow from a reputable lender and make sure to read and understand the terms and conditions of the loan, same day loans can be a safe option for those in need of quick funds.